On Thursday November 26th, Team Sweden had a virtual meeting with Country Managing Director, Luis Salvaterra, Country Marketing & Communications Director, Albina Nunes and Country Financial Director Paula Sant Ana at Intrum Portugal to learn more about its operations and how they are playing a critical role for a well-functioning financial ecosystem.

We learned about how Intrum adapted their business operations in Portugal and how they put over 90% of their coworkers on remote working since March to continue operations during the pandemic. We also got a deeper insight on how they are supporting clients by caring for their customers, with ethics, empathy, dedication and solution.

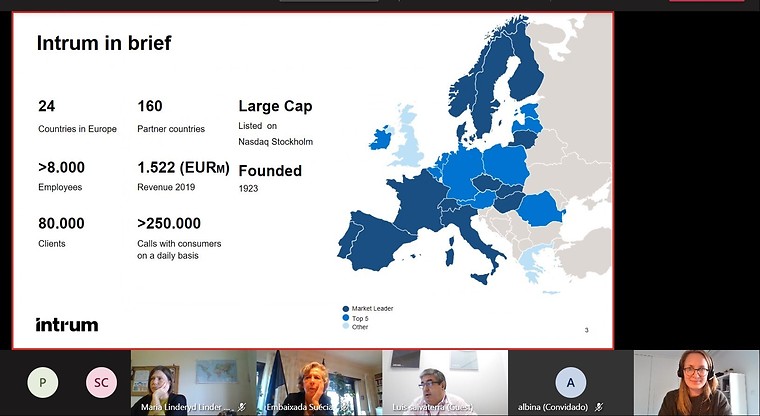

Intrum AB is a company close to 100 years old, founded in 1923 in Sweden, today existing in 24 countries with subsidiaries, and 160 countries with partner companies, the group employ over 8.000 people and take care of 80 000 clients worldwide.

In Portugal, Intrum opened up in 1997 and have offices both in Lisbon and Porto. Today Intrum employs more than 250 people and during their growth journey the last 20 years, they have also acquired four companies in Portugal.

Their client base today consists of approx. 700 clients, and Intrum is well integrated in the Portuguese market within leading sectors of clients such as Bank & financial, telecom and utilities.

The company offers both services and portfolio investments, on behalf of the clients, they collect debts that the client’s clients might have. The company plays a critical role in a well-functioning ecosystem and have a strong value proposition.

With core values such as Ethics, Empathy, Dedication and Solution, they are a one-stop shop across all the value chain of payments and work towards the purpose to help their clients to get a better life, through:

On a CSR perspective, Intrum in Portugal is one of the sponsors for “the Global Management Challenge” which includes a number of universities and empowers students nationally to grow their knowledge.

Internally they also work together with the group with a “Next generation program” where coworkers have the possibility to work abroad in another Intrum country in order to gain experience and grow.

Since the pandemic hit, several initiatives have been implemented in Intrum Portugal from both health and group directives.

The most impactful change was that they acquired laptops to all employees and moved over 90% to remote working mood.

The remote working has been proven to work relatively well with good productivity and in general the coworkers also enjoy the working from home. People are still enthusiastic and even on a long-term note for the future, Intrum believes there will be more home-working, even in a blended from work – from home model to adapt to.

From the business perspective, there was a fear when COVID19 started, however at the moment the forecast and the actual result, is not much difference for calendar year 2020. Though, for the future it can be unsure as the market will be more fragile and unemployment rate might raise making 2021 a year to be careful and follow the market development.

Finally, we discussed the main similarities and differences between Sweden and Portugal in relation to the line of Intrum business where we got some highly interesting insights, namely:

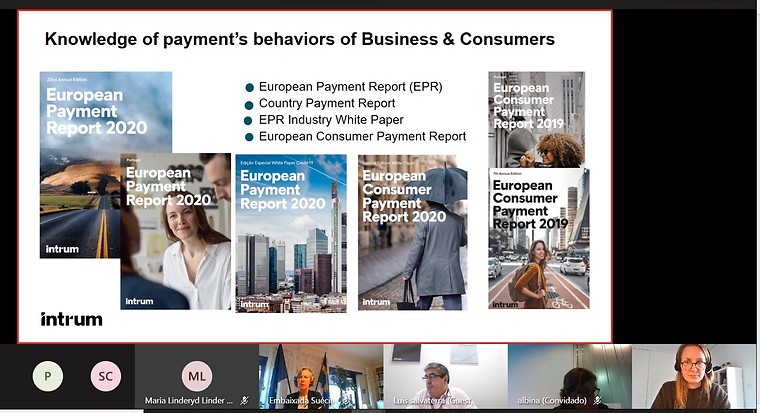

On another note, and referring to Intrums annual European Payment Report, there is a clear difference on lead times on payment between the countries.

Intrum shares valuable insight on why there is such a difference

From all Team Sweden in Portugal, we give our warmest thanks to Intrum for this insightful visit and and feel proud of our member, as the Swedish rooted company's capabilities of being such a critical part, supporting their clients and making sure we have a well-funcitonal finance system.